|

|

|

|

|

He offered to change my tire, and I took him up on his offer. A truly professional will assess your situation and tell you if you have a chance at a successful modification. Lastly, you can find loan modification reps through Zillow Professional Directory, but you must do your due diligence to make sure these people are legit. You can cancel the process at any point, so it is worth trying. New borrowers will be accepted until Dec. While it is not very difficult to find these loans, one must meet certain conditions in order to have the loan approved. Write an appeal letter what is an appeal how to write an appeal letter letter an appeal letter is the first. A loan modification will typically result in the change to the loan's monthly payment, interest rate, term or outstanding principal. The number is on your monthly mortgage bill or coupon book. The FOMC statement excluded references to the massive purchase programs for housing agency debt and MBS (discontinued at the end of March) and noted that all but one of the special liquidity facilities established during the 2008-2009 financial crisis had been closed. Anyone with high combined mortgage debt compared to income or who is underwater (i.e., has a combined mortgage balance higher than the current market value of his house) may be eligible for a loan modification. The Banks are In business to make money (Which is interesting being as its OUR money they use to make more money) so if they have to Evict/foreclose this ususally is an expensive lengthy process. I read a really informative how-to guide that was not lengthy and super informative- gave me the info I needed to negotiate with my bank. Now I know what is expected going through this long- stressful- process. Always check there website and there bbb.org rating. The test compares the expected cash flow that the loan would generate if it is modified with the expected cash flow it would generate if it isn't. Today, this post will deal with step two of Obama’s plan. Hire a professional to do the modification for you. You can find loan modification reps through Zillow Professional Directory, but you must do your due diligence to make sure these people are legit, as well. The operator of this website is a marketer who is compensated for their services as described in our marketing disclosure and does not endorse or recommend any service or product advertised on or through this website. Even worse, many bank negotiators, especially at the larger institutions, are making an effort to demonize third parties while pretending to be altruistic saviors. Theres just lots of red tape that most investors dont want to deal with, time limits and such. I used Prime Loan Advisors in San Francisco; they only service California. The government would then chip in to bring payments down further, to no more than 31 percent of the borrower's monthly income. Over 110 major lenders have already signed onto the program. Take the quiz to see if you might qualify for a loan modification. Homeowners who stay in their properties and are current will get a monthly balance reduction to help reduce their loan principal. But, under the HAMP plan, there are incentives for both lender and borrower. Also, banks would rather have you stay in your home — even if they’re not making the full amount they signed up for — rather than have the house go to foreclosure. A lot of my buddies refuse to even give the US version a chance, most say it seems “too forced.” Either you get British humor or you don’t, in this case the humor can’t translate. Many banks needed huge financial bailouts from American taxpayers simply because the banks were considered “too big to fail.” In general, the banks avoided all accountability for their actions. Speculators — or those who bought homes for investment purposes. To determine if a particular mortgage will be modified, the servicer will perform a so-called net present value test. AT&T, the AT&T Logo and all AT&T related marks are trademarks of AT&T Inc. Based upon this scenario, the Lender should conduct a financial review of the household income and expenses to determine if surplus income is sufficient to meet the new Modified Mortgage Payment, but insufficient to pay back the arrearage. I was so afraid I was going to lose my home. You deserve a loan or get money fast loans no fees info or even no hassle guaranteed often. There could be extra car pricing online charges and hidden. Generally speaking, any change to the mortgage terms is a modification, but as the term is used it refers to a change in terms based upon either the specific inability of the borrower to remain current on payments as stated in the mortgage,[1] or more generally government mandate to lenders. I have search for a legit lender until I got him and I decided to help my fellow humans with this because there are a lot of fake lenders out there and I do not want any body to fall a prey please get to him and tell him that I referred you to him.mail address once more via. A really useful introduction to loan modifications is the free on-line class, Loan Modification Explained in 15 minutes. With $75 billion dedicated to reworking troubled loans, that's a big bet—especially considering that a top banking regulator said last December that almost 53 percent of loans modified in the first quarter of 2008 went bad again within six months. I don’t know what we would have done with their help. You may need a personal loan to fit cimb personal loan into your long or short term plans.

That will amount to up to $1,000 a year for five years. The details of the plan will not be released until March 4, but, in the meantime, call your lender — the company where you got your loan — and ask for the loss mitigation department. Also, if you cannot afford the home due to job loss or a complete inability to pay, you will not be eligible. IRS said I will have to pay taxes on that $88,000 of debt forgiveness. Nevertheless, one could still use the sample letter below as a guide to communicating with friends, in general. Beazer homes, headquartered in atlanta, beazer houses in houston georgia, combines the capabilities of a. The workout plan could result in temporary or permanent changes to the mortgage rate, term and monthly payment of the loan. Copyright 2011, Paxen Learning Corporation. They kept asking for the same things, losing my paperwork, and never returned my calls. It’s free, and loaded with practical info. Also depending on the direness of your financial difficulties, it’s always good to hire legal counsel. The workout plan varies by lender, but changes could include temporary or permanent changes to the mortgage rate, term and monthly payment of the loan, the past due amount could be rolled into the loan, and the new balance re-amortized. Worried about obtaining an fha home loan because you have bad credit. They stand to lose more if you foreclosure than if your loan is modified. Occupancy status will be verified through documents, such as the borrower's credit report. Mortgage modification is a process where the terms of a mortgage are modified outside the original terms of the contract agreed to by the lender and borrower (i.e. Fortunately for her, the media pick up the story and had it all over the news. Department of Housing and Urban Development official during the Clinton administration, called this component of the plan "clever," arguing that it would work to ensure broad participation. Keep copious, detailed notes on who you speak with and details of the conversations so you have documentation down the road if you are faced with foreclosure. Although not everyone agrees with this, billionaire investor Warren Buffett endorsed the philosophy in his most recent letter to shareholders. Nationwide inventory of mobile bank repo homes home bank repossessions. A loan modification is a permanent change in one or more of the terms of a. It is best to have a professional help you just as you would want to hire a lawyer to assist you if you were being sued. Once assembled, I was able to rotate the car with one hand. Scammers make promises that they cannot keep, such as guarantees to “save” your home or lower your mortgage, often for a fee. Payday advances should be used for short-term financial needs only, not as a long-term financial solution. Get a referral from your local state bar association. But supporters argue that mortgage modifications need to be properly engineered to work—and many early ones weren't. The hardest part may be actually finding a car that you can finance. The lender is motivated to offer better terms to the borrower because of the expectation that the borrower might be able to afford a lower payment, and that a performing loan (i.e. Advance fast cash emergency cash generators reviews cash america advance. It is located a few kilometers north of San Juan del Sur and is about a 20-25 minute drive from town. However, the Bank of America did just that to a woman in Wheat Ridge, Colorado. Who’s not eligible for a loan modification. Life has been discovered beneath the Antarctic ice. It’s free and a fun little quiz to keep your visitors engaged. And, if the real estate market is slow, the price could be further reduced. Then he will tell you the steps he will take. Speculators or those who bought homes for investment purposes -- are not eligible.

We all know that the bank is not allowed to foreclose on a property while the homeowners is in the process of a loan modification. I tried for over a year to get a loan modification by myself. I just accepted the Chase offer for a Loan Mod.,Fixed 4%, forgiving $88,000 so I won’t be upside anymore. Wells Fargo Ira Rates TexasThe plan does not, however, require servicers to reduce mortgage principal, which Richard Green, the director of the Lusk Center for Real Estate at USC, considers a shortcoming. I own my home and I have a great job but our daughter got herself in some trouble and my wife refuses to help her. I just recently called my lender about getting a loan modification and was referred to an outside company, I thought they were suppose to handle it internally. The person filing the Chapter 7 in exchange for getting all of their dischargeable debts wiped out, must disclose all of their assets (things and rights they own) to the Trustee. To participate, borrowers will have to sign an affidavit of financial hardship and verify their income with documents. In lowering the payment, the servicer would first reduce the interest rate to as low as 2 percent. What To BringPlease refer to Mortgagee Letter 2009-35 for more details. They took control and did everything for me. |

Seminar Series

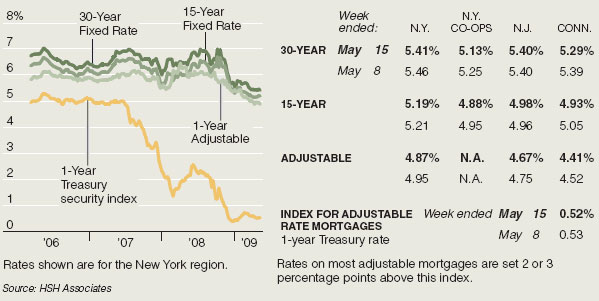

Credit and Finance In the NewsThis is the citi student loans phone number with the shortest wait time and best.

Bank loss mitigation departments are reaching out to homeowners and acting as if they are angels sent to save homeowners. There are many attorneys and firms offering reasonable and affordable fees to Floridians. There are allot of scam companies out there. Contact us as we offer our financial service at a low and affordable interest rate of 3% for long and short loan term.Interested applicant should contact us for further loan acquisition procedures at scofieldloan@gmail.com. The banks even paid out huge bonuses after they received taxpayer bailouts. So my advise is that if you cannot get a loan mod done through your lender defiantly check out a 3rd party company but do your research on them first.

And finally, he will tell you what his fees are, and how they are to be paid.

Wouldn’t you like to be in that business. Or, call a local HUD-Approved Housing Counseling Agency for guidance. To encourage participation, servicers will be paid $1,000 for each modification and will get an additional $1,000 payout each year for as many as three years, as long as the borrower continues making payments. Home Affordable Modification Program, also known as HAMP, is set out to help up from 7 to 8 million struggling homeowners at risk of foreclosure by working with their lenders to lower monthly mortgage payments.

The borrower can be current, late, in default, in bankruptcy, or in foreclosure at the time the application for modification is made.

After the beginning of the mortgage crisis, unscrupulous mortgage professionals began setting up Foreclosure rescue companies promising for a large fee to persuade lenders to modify desperate homeowners mortgages. I just read through all the comments on this blog. I work for a loan mod company and we have helped sooooo many people and I am glad to say I work here. Neither party can receive the cash incentives until the modified loan payments have been made for at least three months. If thats still not enough, the servicer would forebear loan principal at no interest.

Smart Money Week

Foreclosure rescue and mortgage modification scams are a growing problem.

The University ForumIt does not matter if you have not been able to pay for months, received a Notice to Accelerate, Notice of Default, or even a Notice to Sell (foreclosure), a modification of your loan is possible. If we can’t get you the mod, you don’t have to pay anything over the initial retainer. The plan’s goal is to help the borrower reduce their monthly mortgage payments to 31% of their gross income. If thats not enough to hit the 31 percent threshold, they would then extend the terms of the loan to up to 40 years. For short sale, you need to contact a local realtor who is experience in short sale to handle the sale properly.A Short sale is the best alternative when facing foreclosure,if you cant fight no more short sale asap and save your credit. Whether you are trying to find land contract homes in Hyde Park, Chicago, IL, a rent to own home, owner financing or simply a new broker, you will track it all down in one location by utilizing the features offered by our website. It is estimated 3-4 million homeowners will benefit from this plan, but “[The plan] will not reward folks who bought homes they knew from the beginning they would never be able to afford,” said Obama. You should post this same question in the mortgages section of Zillow Advice. The initial retainer amount is only $250 to cover initial processing fees, and the fixed fee is never more than 1.5% of your mortgage.

|

|

|